Analytical Cloud for Finance

WHAT IS THE ANALYTICAL CLOUD?

High Performance Cluster Computing for Finance

The Analytical Cloud for Finance is an easy to use, no coding required, high performance financial markets analytics cluster computing system that runs on your network at home or in the office. In its inaugural release it provides unique market timing analytics that seeks trading systems that maximize the smoothness of your equity performance. It uses a familiar user interface so our existing customers can come up to speed immediately while having a 64 bit concurrent parallel processing high speed cluster computing engine on the back end. This cluster runs locally on your PC, and with the Professional edition, distributed computing across your network.

Smooth Returns for Reduced Drawdowns

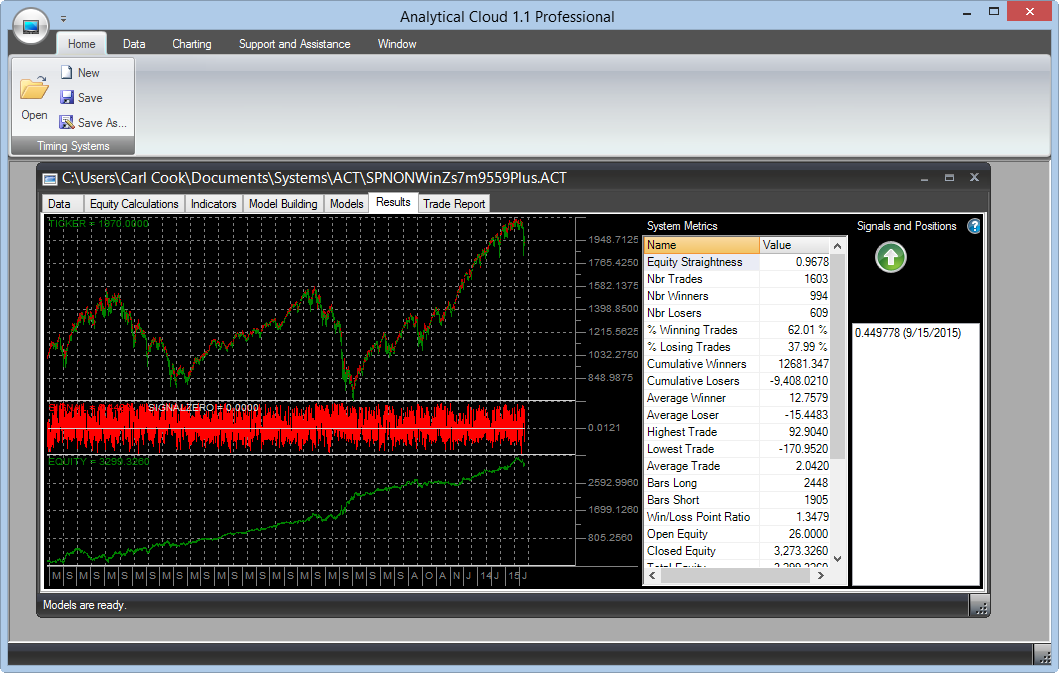

The Analytical Cloud for Finance provides market timing analytics that specifically targets smooth equity performance while searching 10's of thousands of alternative systems. These systems are brought into an "ensemble", a collection of systems, increasing robustness. Search for alternative systems in that collection that work well together. Validate out of sample trading performance before trading.

Get an Edge with Unique Algorithms

This technology is a unique approach to market timing systems, not available elsewhere. It is different from our Dakota, Patterns and Profit products as well. This gives you a new view into the probabilities of securities' price action, one that few others have.

Advanced Machine Learning

In creating market timing systems, the Analytical Cloud for Finance uses functional building block assembly and evaluation technologies, scanning 10's of thousands of alternative sets of mathematical functions, assessing performance on one data set while validating on a second data set, making decisions about utility and performance, assembling solutions that have consistent performance from the indicators and data you have provided. It holds back further data so you can validate the models completely out of sample on-screen. You may optionally perform ensemble search with a mere click of a button, looking for combinations of models that work well together in aggregate. You may optionally prune out models and do other tuning based on a wide variety of performance metrics. You can then load additional data to do further validation.

You create value in the process by bringing in or building indicators by point-and-click as source data for it to use, as well as the means and methods of selecting models that perform to your criteria. You also have control over how many models are assessed, their complexity, the time frames used, and equity calculation settings.

Easy to Use, No Programming Required

Point, Click, Go... No coding is required, no wizards even. That said, The Analytical Cloud for Finance is extensible through indicator, ensemble signal "merging" methods and equity calculation add-ins through .NET template projects.

KEY BENEFITS

Advanced Analytics Cluster Computing for Finance

Buy

Get a license to Analytical Cloud in a one time fee. Click the button to head to the store.

Buy Analytical Cloud! >>KEY FEATURES

What we deliver to you

TECHNICAL REQUIREMENTS

What kind of computer do you need?

The Analytical Cloud has the following technical requirements:

- 64 bit processing ONLY

- Works on 64 bit Windows 7, Windows 8/8.1 and Windows 10

- 8 GB RAM minimum, 16 GB or more is recommended

- TCP/IP Network card for distributed computing

- Minimal hard disk space to install

- Uses .NET 3.5

- Internet connection required to activate and to easily move your license from one machine to another

I am quite impressed at how easy it is to use.

I have been wanting to trade soybeans, but haven't

been able to build a tradable model using any of my

existing tools. It took me about an hour to build a

tradable model

Thank you for a great program!

DISCLAIMER: The Analytical Cloud is not a trading system. It is a software tool for creating market timing systems. The Analytical Cloud's output is not, and should not be considered, trading advice. This web page and others associated with it on this web site may make statements regarding performance of market timing systems created using The Analytical Cloud or for trading and/or trading systems to which The Analytical Cloud may contribute information. This performance is hypothetical or, such in the case of performance statements by customers or members of the press, cannot be or have not been substantiated by records of actual trading and thus must be treated as hypothetical. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.