BioComp Profit 11.0

SIGNAL GENERATOR FOR SYSTEM DEVELOPERS

Walk-forward tested ML signals for NinjaTrader, TradeStation, MultiCharts. You control the strategy.

NO CODING REQUIRED

Build ensemble models without Python or R. Genetic algorithms find patterns. Walk-forward validated.

POWERED BY NEUROGENETIC OPTIMIZER

Battle-tested across healthcare, manufacturing, energy, finance since mid-90s. General-purpose AI, not market curve-fitting.

WHAT IS BIOCOMP PROFIT?

ML Signal Generator for System Developers

BioComp Profit generates predictive signals for traders who build their own systems in NinjaTrader, TradeStation, MultiCharts, or custom platforms.

The Problem It Solves

You know basic indicators (RSI, MACD, moving averages) work sometimes but fail in different market conditions. You've considered building ML models yourself but don't want to learn Python, spend months on it, or risk overfitting.

Profit gives you ML-powered signals without the coding barrier.

How It Works

- You provide: Market data + indicators you want to test

- Profit builds: Walk-forward validated ensemble models using genetic algorithms

- You export: Continuous-valued signals (-1.0 to +1.0) as CSV, DLL, or API

- You integrate: Signals into YOUR platform's strategy builder

- You control: Position sizing, entry/exit rules, risk management, execution

PROFIT GENERATES SIGNALS. YOU BUILD THE COMPLETE SYSTEM.

Think of it as an advanced indicator—but instead of hand-coding rules, genetic algorithms discover which indicator combinations and model structures actually predict your target. Then you use those signals exactly like you'd use RSI or any other indicator in your strategy logic.

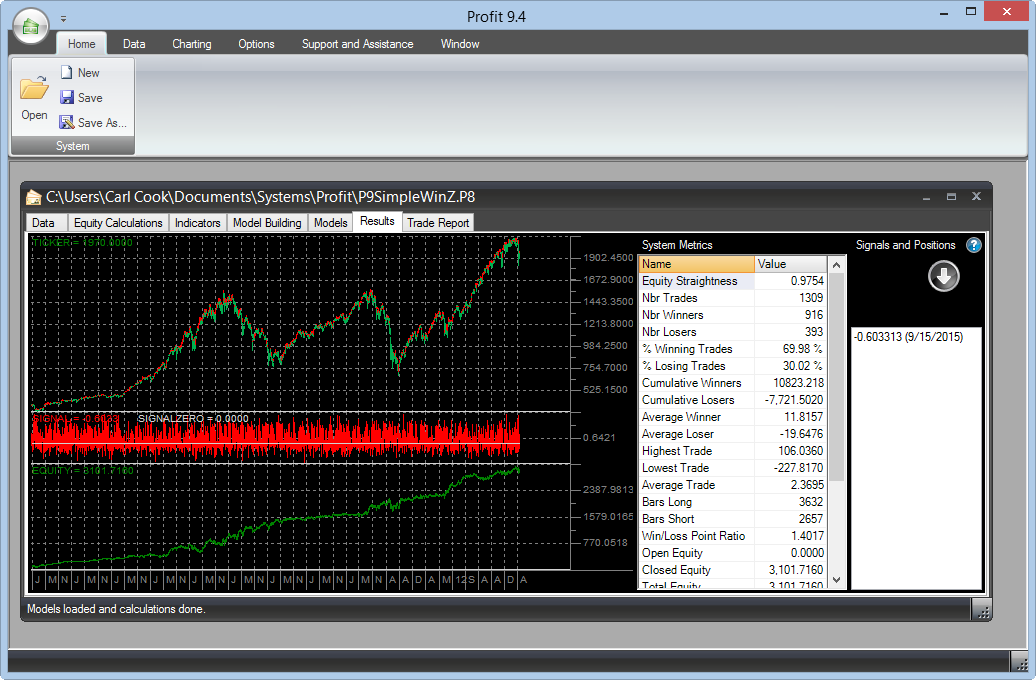

With Profit, you import raw securities data, build indicators then use those indicators as inputs to a modeling process that predicts a "target" (such as the change in the next day's price). The modeling process seeks useful input indicators and performant predictive model types and internal structures. Many models are built and the top performers over the in-sample period are brought into Profit to act as a "committee" of models. The models' signals are combined to create a "System Model" which is more robust. You save your system(s) and each day, or numerous times during the day, update your data and open your Profit systems and view current performance and signals.

NeuroGenetic Optimizer Heritage

Powered by NeuroGenetic Optimizer—battle-tested AI used across healthcare, manufacturing, energy, and finance since the mid-90s. General-purpose modeling, not market-specific curve-fitting.

Good for End of Day "Swing" and Day Trading Too

You can use Profit for end-of-day "Swing" trading, where you take and hold a position (long or short) for some number of days or use the day's forecast to adjust your strategy for day trading, looking to buy dips or short tops depending on the expectation of the day's move direction. Profit also supports reading intra-day data from text files that have date and time in the first column so you can build intra-day models too!

Robustness Verification

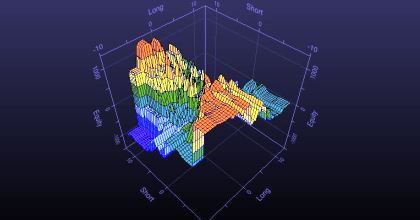

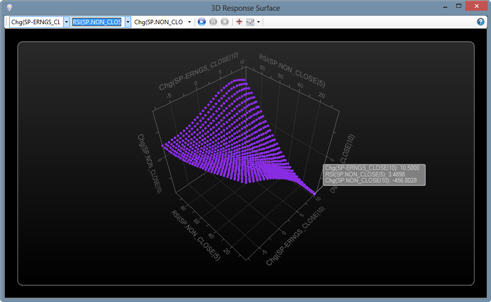

Various features enable you to check the robustness of your systems, including holding back and then processing unseen data and 3D response surface displays that graphically show you models' behavioral complexity.

Key Drivers

Indicator sensitivity analysis lists the indicators ranked by predictive value. Learn which indicators are useful for predicting your target variable.

What Profit Works With

Works with: Stocks, futures, forex, bonds, ETFs (end-of-day or intraday data).

Not suitable for: Options trading.

Profit 11 Walk-Thru Video

LET'S BE CLEAR: WHAT PROFIT IS NOT

Preventing Confusion Since 2005

❌ Profit is NOT:

- A trading platform

You still need NinjaTrader, TradeStation, MultiCharts, etc. - A complete trading system

It generates signals. YOU build the system around them. - A broker or execution engine

It doesn't place trades. Your platform does. - A TradeStation replacement

It's a tool that FEEDS platforms like TradeStation. - A black box signal service

You build and own your models. Full transparency.

✅ Profit IS:

- A machine learning signal generator

Like if RSI was built by AI instead of hand-coded rules. - A modeling engine for system developers

You use it to create better predictive signals. - Complementary to your trading platform

NinjaTrader + Profit signals = better entries than NT alone. - An export tool

Generates signals, exports them, you integrate them. - Under your control

You decide how to use the signals in your strategies.

Think of it this way:

TradeStation = Your workshop

Profit = A specialized power tool in that workshop

You use both together. Profit doesn't replace TradeStation. It gives you better signals to use INSIDE TradeStation (or NinjaTrader, or MultiCharts).

Around 2005, the market started confusing Profit with trading platforms themselves. We're a signal generation tool, not a platform replacement. If you're looking for a complete trading platform, check out NinjaTrader or TradeStation. If you want better ML signals to feed your existing platform, we're here.

KEY BENEFITS

Why System Developers Choose Profit

WALK-FORWARD VALIDATED

Triple validation (in-sample, out-of-sample, walk-forward) prevents the curve-fitting that kills most backtested strategies. Models are tested on data they've never seen. What works forward, not just backward.

ENSEMBLE MODELS

Multiple models vote on each signal—like having 5 expert systems analyzing every setup. When most agree, confidence is high. Genetic algorithm finds which combinations work best together. More robust than single-model approaches.

NO CODING REQUIRED

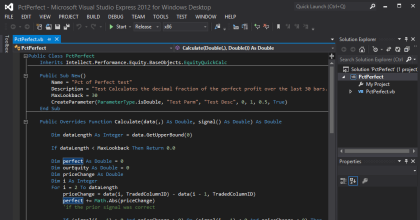

Point-and-click model building. You don't need Python, R, or programming skills. But if you DO code, Profit supports custom indicators via .NET add-ins. Accessible to non-programmers, extensible for developers.

INDICATOR SENSITIVITY

See which indicators actually matter. Ranked list shows predictive value of each input. Drop weak indicators, keep strong ones, rebuild models. Invaluable for discovering what drives your signals and eliminating noise.

PLATFORM INTEGRATION

Export signals as simple CSV files. Works with all trading platforms, including NinjaTrader, TradeStation, MultiCharts, ThinkorSwim, Interactive Brokers, MetaTrader, Python, and custom platforms. Super simple integration. Full flexibility.

GENETIC OPTIMIZATION

Genetic algorithms evolve model architectures, not just parameters. Searches billions of possible combinations to find structures that predict your target. Mesh regression captures non-linear patterns basic indicators miss.

EQUITY-OPTIMIZED

Models optimize for profitability, not just prediction accuracy. A 60% accurate model that catches big moves beats a 75% accurate model that predicts noise. Profit targets what matters: your bottom line.

3D VISUALIZATION

Response surface plots show model complexity visually. See how models behave across input ranges. Identify overfitting before it bites you. Insights no other platform provides.

USA-BASED SUPPORT

Real support from people who understand system development. Email, forum, and training classes available. We stand behind our tools. Active user community shares integration examples and strategies.

KEY FEATURES

What we deliver to you

WHY YOU WON'T FIND MANY TESTIMONIALS

And Why That's Actually a Good Sign

System developers who find profitable edges don't advertise them. Market efficiency is real—if everyone knows about a pattern, it stops working.

We've had customers call to say thanks. One found a lagged correlation between a US security and a French one—watched US close, traded French security, profitable edge. He was thrilled. But he'd never post that publicly.

At our training workshops, traders whisper "come here, look at this" and show us their results privately. They won't share specifics on forums. That's smart trading.

Used by Professionals at Major Institutions

Profit has been used by traders and analysts at Standard & Poor's, Invesco, TransUnion, and other institutional firms—both professionally and for personal trading. We can't name individuals or share their strategies (they wouldn't want us to), but institutional-grade traders choose Profit for signal generation.

What we CAN tell you: Profit has been used by system developers since 2002. The NGO engine behind it has been deployed across healthcare, manufacturing, and energy since the mid-90s. It works. But don't expect traders to prove it publicly—that would defeat the purpose of having an edge.

"The best signal generators don't have flashy testimonials. The traders who benefit stay quiet and keep trading."

TECHNICAL REQUIREMENTS

What kind of computer do you need?

BioComp Profit has the following technical requirements:

- Operating System: Windows 7, 8/8.1, 10, or 11

- RAM: 4 GB minimum, 8-16 GB recommended

- Processor: Multi-core recommended (faster model building)

- Hard Disk: Minimal space required

- Internet: Required for license activation and transfers

Note: Windows-only. Mac users can run via Parallels, VMware, or Boot Camp.

Ready to Build Better Trading Signals?

Stop relying on basic indicators that work sometimes and fail in other market conditions. Generate walk-forward tested ML signals without learning Python or risking months of development time.

Used by system developers since 2002. Powered by NeuroGenetic Optimizer—battle-tested across industries since the mid-90s.

For serious system developers, not tire-kickers.

DISCLAIMER: BioComp Profit is not a trading system. It is a software tool for creating market timing systems. BioComp Profit's output is not, and should not be considered, trading advice. This web page and others associated with it on this web site may make statements regarding performance of market timing systems created using BioComp Profit or for trading and/or trading systems to which BioComp Profit may contribute information. This performance is hypothetical or, such in the case of performance statements by customers or members of the press, cannot be or have not been substantiated by records of actual trading and thus must be treated as hypothetical. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.